I came to

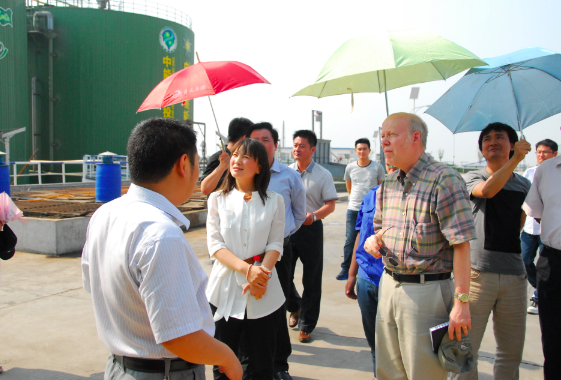

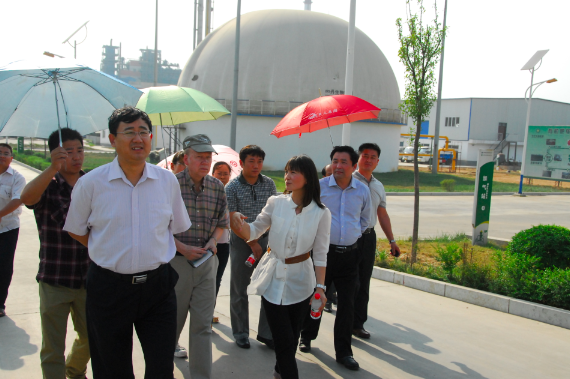

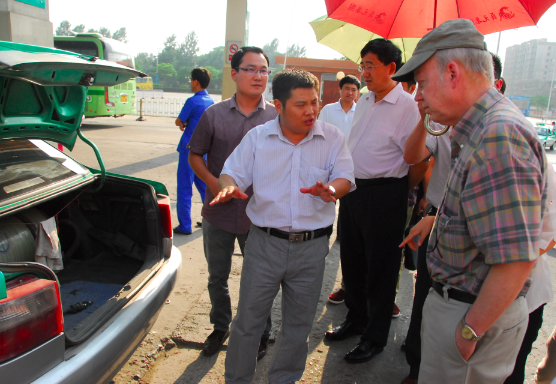

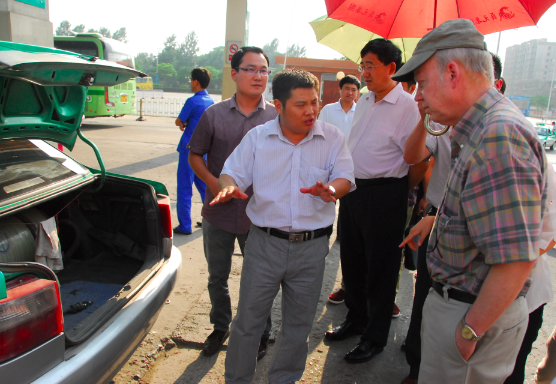

see that the Zhenyuan group unlike most companies in the

green energy field in China has all of the right parts in place:

production of both coal bed methane and bio gas, production of

DME, distribution, storage and retail sales to the consumer.

Provision for conversion of cars, trucks and buses to utilize methane

as a transportation fuel which I understand pays off for many owners

after

only one month because of the lower methane cost as compared to

gasoline or diesel. The energy conference Zhenyuan Group has

taken the lead in organizing has made Anyang well known in China for

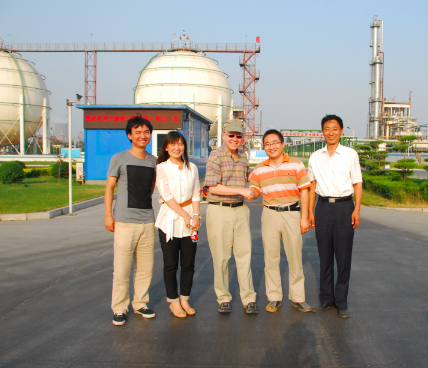

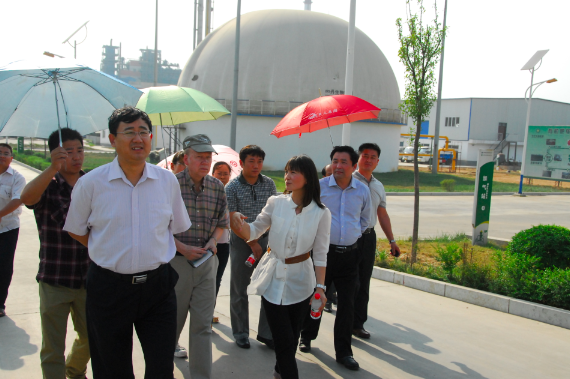

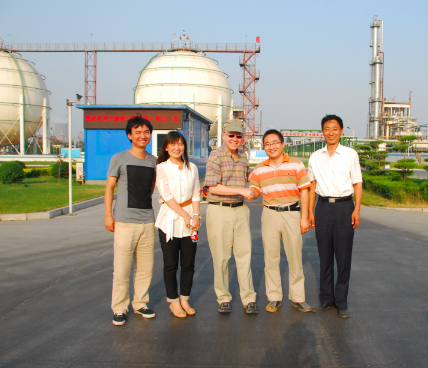

its pioneering role in green energy. The Green Energy Industrial

Park, which already exists at a demonstration level and is being

expanded, are gaining notice from foreign green energy companies as a

good location to demonstrate and test new green energy and energy

efficiency technologies in China. Each of these are parts of the

total package that Mr. Pian Yunlai, the founder, has put all

together with a vision to build China’s leading and most professional

green energy company.

* China coal bed methane output will

surge 50 percent in 2012

*

Coal bed Methane is expected to reach 230 Bcm by 2015.

Gas output from the coal seams mainly of Shanxi province, which

neighbors to Henan province where Anyang is located, is rising fast and

is set to hit 8 billion cubic metres (bcm) this year, up a half from

2011 - emerging from nowhere just six years ago to provide China with a

cleaner, local alternative fuel for the future.

China is investing 100 billion yuan ($16 billion) to double output

again by 2015. Beijing wants coal seam gas output as high as 30 bcm by

2020, which would be 15 percent of China's total gas production, up

from 5 percent of the total last year. Beijing plans to double the

share of natural gas in its energy mix by

2015 and reduce coal's role in a drive to ease pollution and slow

greenhouse gas emissions. China will import more gas, but it also aims

to boost output from domestic natural gas fields as well as

unconventional sources such as coal beds and shale.

Within the next 10-15 years, China's CBM output could eclipse the

annual output of top CBM producer the United States' of around 50 bcm,

executives at companies involved in the sector say. The bulk of that

output will come from Shanxi's aging and dangerous mines which

hopefully will be made safer by extracting the gas before the coal.

Besides the safety advantages of extracting the methane gas and the

fact that methane is a much cleaner transportation fuel than gasoline

or diesel, coal bed methane should be extracted because it is

also better for the environment than letting the methane - a greenhouse

gas 20 times more potent than carbon dioxide - enter the atmosphere

which often happens at present and provokes tremendous ecological

damage.

Even though the U.S. government estimates China sits on the world's

biggest shale gas reserves, coal bed methane is now the lowest hanging

fruit for China and companies like the Zhenyuan group are moving to

help China convert to this cleaner fuel. Soaring coal output has

powered China's growth into the world's second-largest economy and

exploitation of coal bed methane will help China to meet growing energy

needs with cleaner fuels from its own resources while research and

development on shale gas reserves and the geology surrounding them is

further researched and investigated. This will allow China to

find and exploit the drilling and other procedures for shale gas that

work best in its distinctive geology. Chinese shale may hold

1,275 trillion cubic feet (36 trillion cubic meters of gas), or 12

times the country’s conventional natural gas deposits, the U.S. Energy

Information Administration said in April. China’s “technically

recoverable” reserves are almost 50 percent more than the 862 trillion

cubic feet held by the U.S., the EIA said.

I was very impressed by the Zhenyuan group and their pioneering CEO

Pian Yunlai. China has a big challenge ahead of itself to meet

its growth targets and energy needs in a more ecologically responsible

and cleaner way. Although their are certainly excesses in China

and air pollution is still in need of further and stricter curbs,

companies like the Zhenyuan group are trying to find ways that make

sense for China and that help to balance cost with cleaner

transportation alternatives. Zhenyuan Group has big plans to be a

part of the solution and it is a name to watch.

About the Author:

Christopher W. Runckel, a former senior US diplomat who served in many

counties in Asia, is a graduate of the University of Oregon and Lewis

and Clark Law School. He served as Deputy General Counsel of President

Gerald Ford’s Presidential Clemency Board. Mr. Runckel is the principal

and founder of Runckel & Associates, a Portland, Oregon based

consulting company that assists businesses expand business

opportunities in Asia. (www.business-in-asia.com)

Until April of 1999, Mr. Runckel was Minister-Counselor of the US

Embassy in Beijing, China. Mr. Runckel lived and worked in Thailand for

over six years. He was the first permanently assigned U.S. diplomat to

return to Vietnam after the Vietnam War. In 1997, he was awarded the

U.S. Department of States highest award for service, the Distinguished

Honor Award, for his contribution to improving U.S.-Vietnam relations.

|