Biotechnology in

India

While India has been practicing conventional biotechnology for

decades, modern biotechnology did not really take off in India

till the last decade. However, this process is now accelerating

and India will soon be a leader in many forms of biotechnology.

Currently, there exist 800 companies, operating in all sectors of

biotechnology, but there are only 25 companies that have gained size

and are working in the modern biotech sectors. Leading companies

are Reddy Labratories, Wockhardt, Biocon, Panacea Biotech, Biocon,

Nicholas-Piramal India, Reliance and Ranbaxy.

Today, India holds a small share of the global biotech market, but has

all the capabilities to become a dominant player. Biotech in

India has three dominant clusters - Bangalore, Mumbai/Pune and to a

lesser extent New Delhi.

In 1997, the total biotech market in India was valued at $ 500 million.

This grew to 1 billion in 1999. It further grew to 2 billion in

2001 and is expected to grow to $ 4.5 billion by 2010. Some

expect that India will have 8 percent of the world's biotech companies

by 2010.

India is a hub for vaccine production. In 2003/2004, this market grew

at 18.64% and accounted for 47% of the total biopharma segment with

sales of US$253 million. GlaxoSmithkline, Wyeth, and Aventis are major

multinational players in the Indian vaccine market.

Several domestic players are competing in this market such as Serum

Institute of India (Pune), Biocon, Panacea Biotec, etc. . Major

vaccines produced include DPT, DT, BCG, Tetanus toxoid, oral polio,

measles, mumps, rubella, hepatitis B, rabies (tissue culture-based),

and an injectible typhoid vaccine.

The human and animal segment of the industry alone is growing by at

least 20%. Human health biotech accounts for 60% of the total sales,

while agro biotech and veterinary-biotech together account for 15% of

the total revenue and medical devices, contract R&D and reagents

and supplies constitute the remainder.

The biotech sector in India is still mainly a mix of small and

medium-sized companies. Major hurdles for Indian biotech start-ups are

finding seed capital, lack of R&D focus, intellectual property

rights, regulatory reforms and difficulty in competing with large

companies in terms of salaries and benefits for key employees.

Areas of Focus:

- Bio-generic pharmaceuticals. The reason for this is India's

long presence in the generic drugs market which is now leading the

Indian companies to enter the Bio-generic pharmaceutical global market.

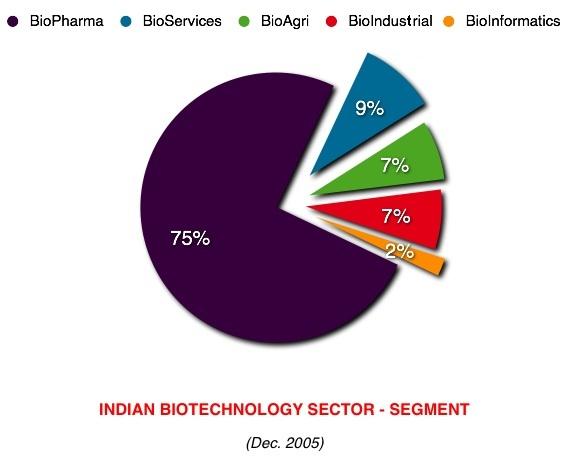

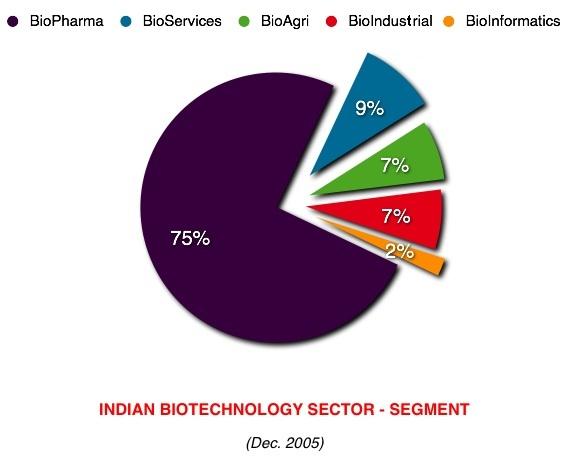

The biopharmaceutical segment contributed about 76% of the Indian

Biotech market in 2003-2004.

- Agribiotechnology. Agriculture occupies the prime position in the

economy contributing 24.1% to the GDP and agricluture and allied

activities employ about 60% of the work force. Hence a lot is expected

of agribiotechnology. New products in agribiotechnology sector would be

increasing in the coming years.

- Clinical Trials - India offers great advantages in conducting

clinical trials. These include speed of patient enrollment, which is

higher than in Western countries, an excellent pool of qualified

doctors and investigators, expertise in computer skills including data

management, a heterogeneous population, and conformation to ICH and GCP

guidelines. Multinational companies, such as Eli Lilly, are

already reportedly spending over 10% of annual turnover on clinical

trials in India.

- Vaccines - see above.

Biotech for Diverse Sectors

Pharmaceutical & Health Care

Agricultural & Food Biotechnology

Crops

Food Crops

Non-Food Crops

Animal

Forestry

Biopesticides, Biofertilizers & Biofuels

Industrial Biotechnology & Bioprocessing

Environmental Biotechnology

Phyto-remediation

Bio-remediation

BioOutsourcing

Biomedical R&D

Contract Research

Clinical Research and Clinical Trial

Biotechnology Research Organization (BRO)

Biopharmaceutical Contract Manufacturing (BCM)

Biogeneric

India Advantage

Plant Genetic Resources

Animal Genetic Resources

Tropical Forest

Agro-Climatic Zones

Infrastructure-R&D Institutions, Universities and Hospitals

Skilled Manpower

Biotech Financing

Government Funding

R&D (technology development)

Technology Commercialization

Venture Capital

Institutional/Individual Financing

Comparing India to China and Thailand:

Special Reviews:

Biotechnology Outsourcing: Which Country is Right for my Company?

Biotech is considered the next IT, with fortunes to be made and every

major economy in Asia rushing to establish itself as a major player and

prime destination for foreign investment. This article focuses on

China, India and Thailand from the perspective of a biotech firm seeking

to establish an R&D lab or processing facility in one of these countries

Chronology of Indian Biotechnology Industry

1978 -

First Indian Biotech company, Biocon, is established in Bangalore.

1981 -

Center for Cellular & Molecular Biology (CCMB) is established in

Hyderabad for

DNA & r -DNA based research.

1984 -

For R&D activities in microbial Bio -processing, Institute for

Microbial Technology

(IMTECH) is established in Chandigarh.

1986 -

Department of Biotechnology (DBT) is set up by Government of India with

objective of promoting modern Biology and Biotechnology at academic and

industry levels.

1987 -

National Institute of Immunology (NII) set up by DBT for immunology

research.

1989 -

Bangalore Genei starts operations to produce restriction enzymes &

other tools for

DNA based R&D.

1991 -

National Center for Biological Sciences (NCBS) established to pursue

R&D in

molecular biology.

1996 - Bharat Biotech International Ltd. Establishes an R&D centre at

Genome Valley,

Hyderabad

1997 -

Center for Biochemical Technology (CBT) established to focus on

Bioinformatics and Genomics.

Shantha Biotech launches India's first recombinant product,

Hep B vaccine.

1998 -

Monsanto research establishes an R&D center at

IISc for plant genomics.

DBT approves Mahyco -Monsanto to conduct Bt cotton trials.

1999 -

NCBS scientist sets up AVESTHAGEN a plant genomics company.

2000 -

Andhra Pradesh, Karnataka, Maharashtra and Tamil Nadu announce Biotech

initiatives.

2001 -

Reliance sets up Reliance Life Sciences to pursue stem cell based

research and

product development.

2003 -

Gujarat government announces Biotech Venture Capital Fund

Wockhardt launched Wosulin (rDNA human insulin) and Biovac -B

(hepatitis B

Vaccine) and Wepox (Erythropoitin)

Strand Genomics launched Avadis 2.0

2004 -

Biocon rollout with its public issue

Ocimum Biosolution entered into partnership with Genome Exploration of

US

|