Vietnam is Getting Tax Policy Ready for the ASEAN Economic Community (AEC)

Vietnam has taken steps to improve the business community's capacity to cope with competition when the ASEAN Economic Community (AEC) begins operations late in 2015. The establishment of the AEC provides both opportunities and challenges for Vietnam's business community. It will help Vietnam expand markets, but at the same time attract more aggressive competition at home, particularly in industrial and agricultural sectors.

ASEAN comprises 10 member states, including Indonesia, Malaysia, the Philippines, Singapore, Thailand, Brunei, Cambodia, Laos, Myanmar and Vietnam. The AEC aims to establish a single common market and production base for ASEAN member countries that enables the free movement of goods, services, capital and skilled labour within ASEAN.

By the end of 2014, about 75% of import tariffs in ASEAN countries were reduced to zero under the ASEAN Free Trade Agreement, which precedes and complements the establishment of the AEC. Joining the AEC means that tariffs committed for elimination under the ASEAN Free Trade Agreement will be made ahead of the scheduled 2018. It has dropped tariff rates to 0% for 80% of tax lines and removed tariffs for another 13-15%. The rest will be progressively removed until 2018.

"... Vietnam is moving to make itself more competitive as a site for manufacture and that tax policy will be one of the pillars it utilizes to gain an advantage vis-a-vis that its other ASEAN neighbors..."

Businesses also enjoy regulations on preferential treatment and investment protection under the double-tax avoidance agreements that Vietnam has signed with other countries.

Nguyen Van Phung, head of the Department of Taxation's Large Taxpayers Office, told Dien Dan Doanh Nghiep (Business Forum) newspaper that:

1.) Businesses with income generated from agriculture will get preferential tax from 2015 to encourage more investment in the field of agriculture. Specifically, corporate income tax exemption is applicable to co-operatives with income from farming, husbandry, agricultural processing, fisheries and salt production. The lowest rate of corporate income tax of 10% will be applied for businesses with income from forest protection and planting as well as aquaculture and seafood processing in disadvantaged areas. |

2.) A new tax regulation has been applied this year to encourage more businesses to invest in auxiliary industry and hi-end technology. Under the regulation, a preferential tax rate of 10% of corporate income tax will be applied for 15 years to businesses investing in industrial products prioritized for development. The regulation also targets new projects with a minimum capital of VND12 trillion (US$560.74 million) using hi-end technology. However, investment in production of products subject to the special consumption tax or mineral exploitation projects will not benefit from the regulation. |

3.) Preferential tax has also been applied from the start of the year to projects with adverse impacts on job creation and economic structure in Vietnam. |

Despite the likelihood that the start of the Asean Economic Community at the end of 2015 will not see all goals met, it is obvious from the above changes that Vietnam is moving to make itself more competitive as a site for manufacture and that tax policy will be one of the pillars it utilizes to gain an advantage vis-a-vis that its other ASEAN neighbors.

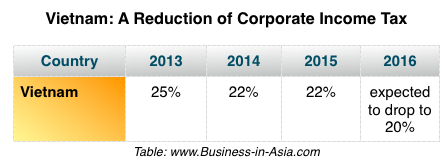

Tax-related policies are among the key measures the Government has set out, according to Vietnam News. A reduction of corporate income tax from 25%t to 22% in 2014 is one among a number of measures taken to help local businesses ready themselves for the ASEAN Economic Community. The corporate income tax is expected to drop to 20% in 2016. The country also has improved other tax procedures and a one-stop customs system and step upped other necessary preparations for the establishment of the ASEAN Community.

Follow us on Twitter: @InsightNewsAsia

Copyright © 2015: Runckel & Associates, Inc

Visit our other website: Asia-Art.net

|

|